🏠 How to Get a Home Loan in Nepal (2025 Guide) – Full Process, Documents & Timeline

Planning to buy a house in Nepal? This complete guide explains how to get a home loan in 2025—from eligibility and documents to bank process, approval time, and expert tips.

🏡 Introduction: Why Home Loans Matter in Nepal

With rising property prices in cities like Kathmandu, Pokhara, and Biratnagar, most Nepali families can’t afford to buy homes outright. That’s where home loans come in—offering a structured way to own property while spreading payments over time.

Whether you’re a salaried employee, business owner, or remittance earner, this guide will walk you through the entire home loan process in Nepal, including:

- Eligibility criteria

- Required documents

- Step-by-step bank process

- Loan approval timeline

- Expert tips for faster approval

- SEO keywords and meta tags for bloggers

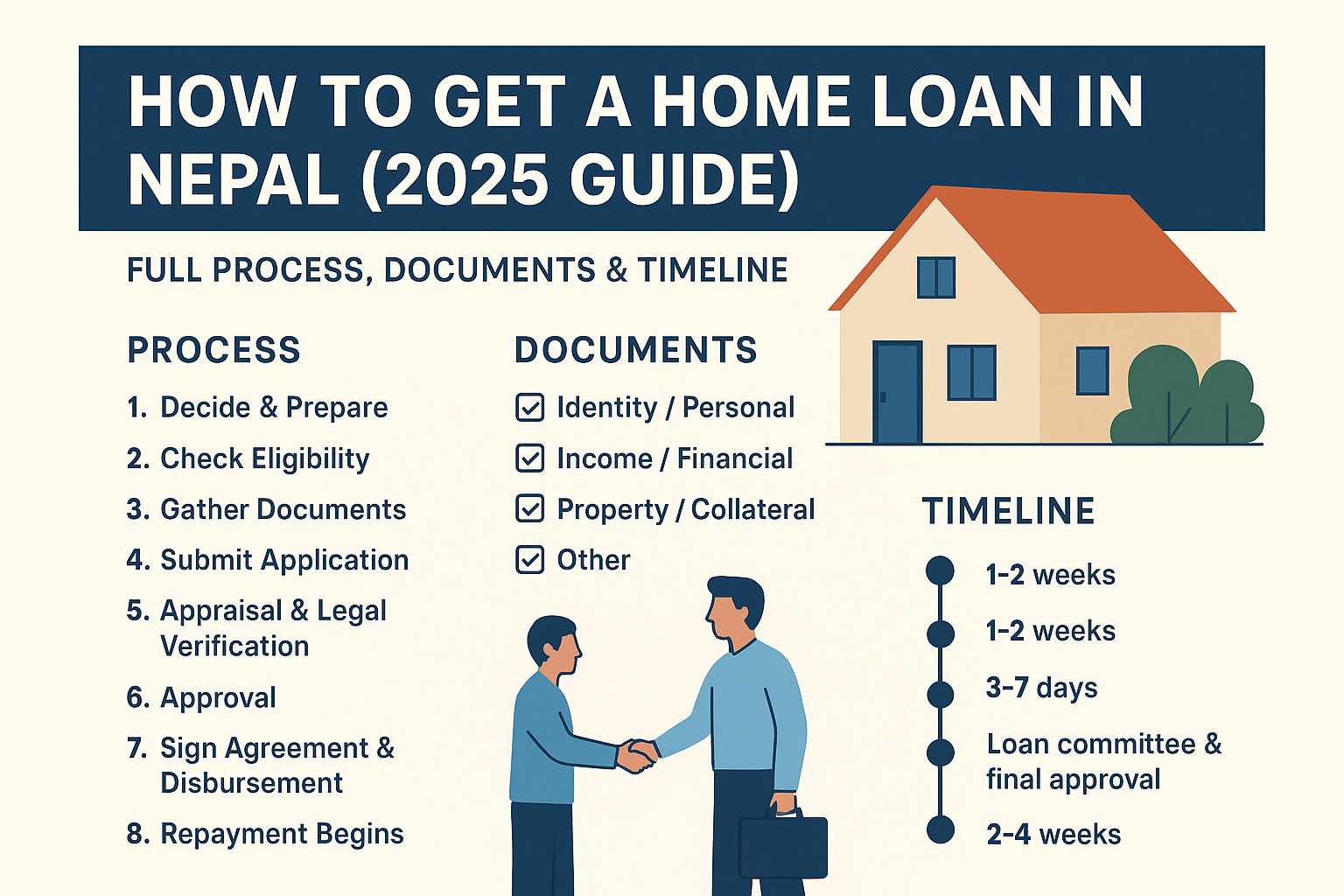

✅ Step-by-Step Home Loan Process in Nepal

1. Research & Compare Banks

Start by comparing banks and financial institutions. Popular choices include:

- Nabil Bank

- NIC Asia

- Global IME Bank

- Siddhartha Bank

- Nepal Bank

- Rastriya Banijya Bank

Compare these factors:

| Criteria | What to Check |

|---|---|

| Interest Rate | Fixed vs. floating (8%–15%) |

| Loan Tenure | Usually 5–25 years |

| Processing Fee | NPR 1,000–5,000 |

| EMI Flexibility | Monthly or quarterly options |

| Customer Service | Reviews and branch accessibility |

2. Check Your Eligibility

Banks assess your financial stability before approving a loan. Key eligibility criteria include:

- Age: 21–65 years

- Citizenship: Must be a Nepali citizen

- Income: Stable monthly income (salary, business, rental)

- Credit History: Clean repayment record

- Property: Must be legally registered and mortgageable

Income Requirements

| Employment Type | Minimum Monthly Income | Additional Requirements |

|---|---|---|

| Salaried | NPR 25,000–40,000 | Salary slips, tax docs |

| Self-employed | NPR 30,000+ | Business registration, income proof |

| Remittance | NPR 20,000+ | Bank remittance records |

3. Prepare Required Documents

Here’s a checklist of documents you’ll need:

Personal Documents

- Citizenship certificate

- PAN card (if applicable)

- Passport-size photos

- Relationship verification (if joint loan)

Financial Documents

- Salary slips (last 6 months)

- Bank statements (last 6 months)

- Tax clearance certificate

- Business registration (for entrepreneurs)

Property Documents

- Land ownership certificate (Lalpurja)

- Recent land revenue receipt (Malpot)

- Four Boundary Report (Char Killa)

- Rajinama or Bakaspatra (if inherited)

- Blueprint and valuation report from municipality

4. Visit the Bank & Apply

Once your documents are ready:

- Visit your preferred bank branch

- Fill out the home loan application form

- Submit all documents

- Pay the processing fee

Banks may also ask for a loan purpose declaration and property seller details.

5. Bank Evaluation & Property Inspection

After submission, the bank will:

- Inspect the property

- Verify income and employment

- Check credit history

- Assess loan-to-value ratio (usually 70–80%)

They may also conduct a legal due diligence to ensure the property is free from disputes.

6. Loan Approval & Sanction Letter

If everything checks out, the bank will issue a sanction letter detailing:

- Approved loan amount

- Interest rate

- EMI schedule

- Loan tenure

- Terms & conditions

You’ll need to sign a loan agreement and mortgage deed.

7. Loan Disbursement

After signing, the bank will:

- Transfer the loan amount to your account

- Or directly pay the seller (in case of purchase)

You can now proceed with property registration and ownership transfer.

📅 Home Loan Timeline in Nepal

| Stage | Estimated Time |

|---|---|

| Document Collection | 2–3 days |

| Application Submission | 1 day |

| Bank Evaluation | 5–7 working days |

| Loan Approval | 3–5 working days |

| Disbursement | 2–3 working days |

Total Time: Approximately 2–3 weeks

💡 Expert Tips for Faster Approval

- Choose a bank near your property location

- Maintain a clean credit history

- Submit complete documents in one go

- Get a professional land valuation report

- Avoid applying to multiple banks simultaneously

- Use a co-applicant to increase eligibility

🧠 Common Mistakes to Avoid

- Submitting incomplete documents

- Ignoring credit score

- Choosing property with legal disputes

- Not comparing interest rates

- Overestimating repayment capacity

🧠 Common Mistakes to Avoid

📌Conclusion

Getting a home loan in Nepal is easier than ever—if you follow the right steps. With proper documentation, financial planning, and bank comparison, you can secure your dream home without stress.

Whether you’re buying in Kathmandu, Lalitpur, or Pokhara, this guide ensures you’re fully prepared for the journey.